We need a Citizens’ Wealth Fund so everyone shares in economic growth, says Carys Roberts from IPPR

A Citizens’ Wealth Fund for the UK, worth £186bn by 2030, would distribute its returns in the form of a £10,000 universal minimum inheritance paid to 25 year-olds, according to a recent proposal from IPPR.

The proposal attracted headlines and considerable debate, as wealth inequality, particularly between generations, has been front and centre of recent political and public concerns. The latest data – likely to be an underestimate of the true scale of wealth inequality due to sampling issues – shows that the wealthiest ten per cent of households own five times as much wealth in aggregate as the least wealthy half of households.

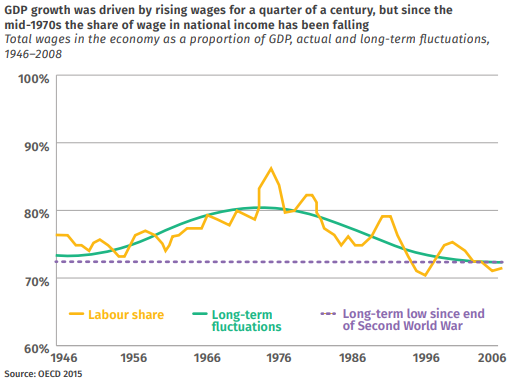

Tackling this huge gap requires an understanding of the drivers of wealth inequality in the UK. Primary among these is the growing share of national income going to the owners of capital in the forms of profits and rents. A range of reasons from capital mobility, financialisation, and the weakening of labour bargaining power mean that wages have not kept up with economic growth, and the wage share of national income has been in decline since the 1970s.

This wouldn’t be a problem for inequality if everyone held an equal amount of assets. But as the data shows, this is far from the case in the UK. Financial assets, such as stocks and shares, are the least evenly distributed type of asset. Whereas housing acted as a wealth equaliser through much of the twentieth century, sky-high prices mean that rates of home ownership are going down, and whether you own your home increasingly depends on whether your parents can and will help you to do so.

What’s more, powerful technological trends are set to make wealth inequality worse. Automation of tasks performed by humans has the potential to make society very wealthy, but without intervention the rewards are likely to flow disproportionately to the owners of robotics, AI and businesses that use them, including the digital platform giants.

The good news is that growing wealth inequality is not inevitable; there are several ways to stop rising inequality if we reimagine our economy’s foundational institutions. First, we could strengthen unions to increase the bargaining power of workers. Second, we could tax wealth and the income that wealth generates more effectively: currently our tax system taxes income from work and productive investment more than it taxes unearned economic rents. Third, we could broaden wealth ownership, to make sure that everyone can benefit from increasing returns to capital.

A Citizens’ Wealth Fund would be a powerful countervailing force to wealth inequality in this final category, as it would transform who owns capital. It could be set-up through progressive taxation of corporate and private wealth, alongside a small amount of borrowing and the transfer of existing assets including remaining RBS shares. The fund would provide a means to smooth ‘windfall’ assets such as the sale of the 5G spectrum, to ensure that future generations can share in our national wealth. While it would be managed independently, this would be a fund owned by and run in the interests of citizens, and sharing in the returns would be a right of citizenship.

How those returns would be distributed to benefit citizens is a topic for debate. We propose a universal dividend for 25-year-olds, which would address the problem of unequal individual wealth most directly and create a broad political constituency to support the Fund going forwards. Research by others, supported by Friends Provident Foundation, proposes using some of the returns to fund social care.

A growing chorus of voices – including IPPR, City University academics, NEF, RSA, Conservative MP John Penrose and fund managers at M&G – are calling for a sovereign wealth fund to be established, along the lines set out above. The City University and Friends Provident Foundation will be bringing some of these voices together at an event on the 10th May. What is clear is that the enormous challenge of wealth inequality cannot be ignored any longer, and it will require bold solutions. A Citizens’ Wealth Fund could be the big idea we’re looking for.

Carys Roberts is a Senior Economist at IPPR and co-author of the report Our Common Wealth: a Citizens’ Wealth Fund for the UK. She tweets @carysroberts.